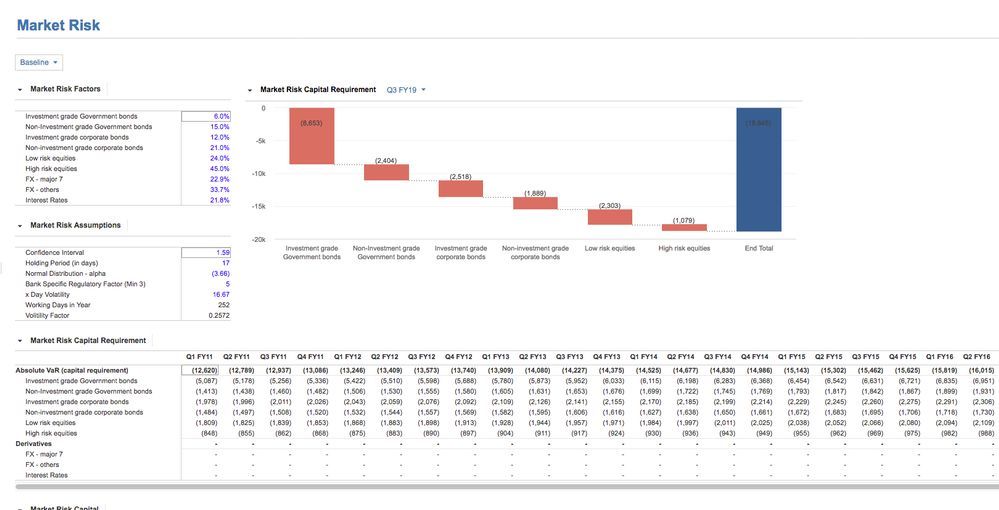

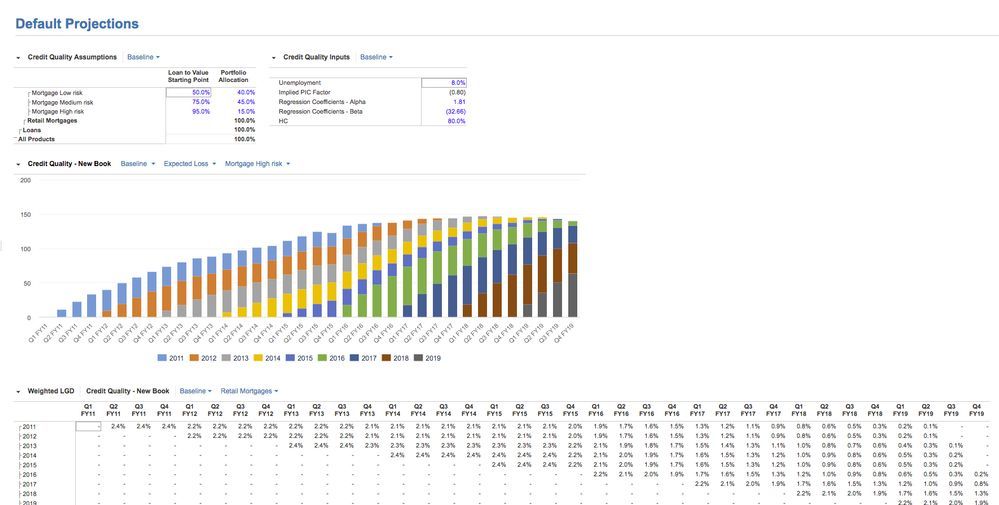

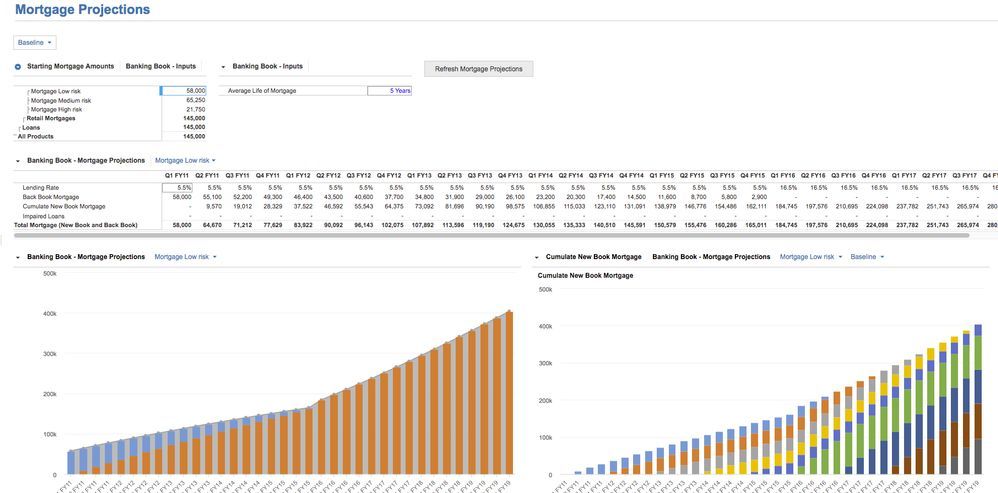

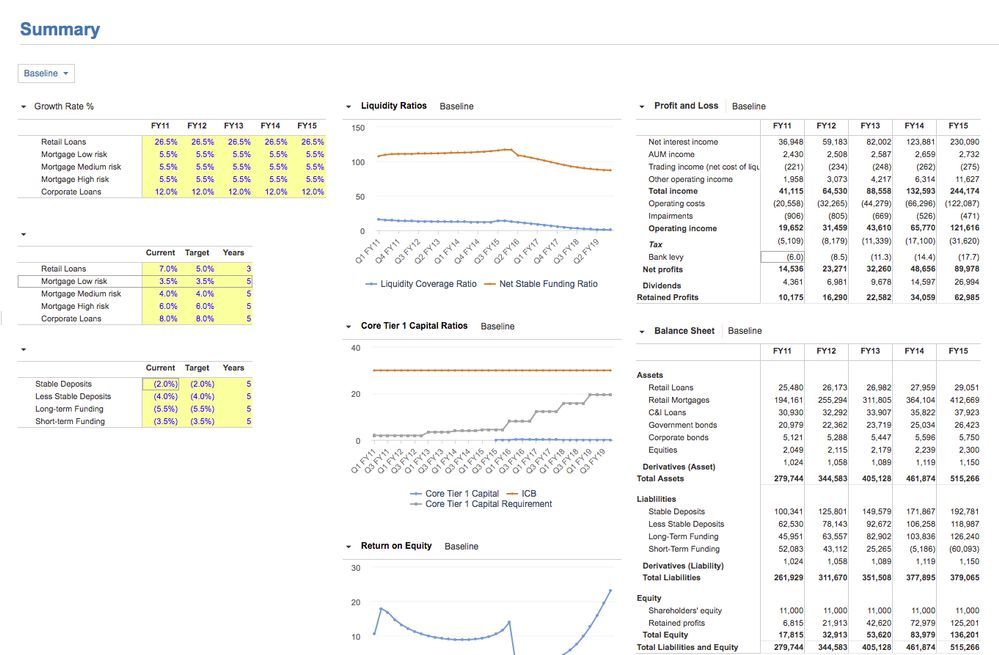

The Planning, Budgeting, and Forecasting for Banking model example captures a wide variety of capabilities for the banking industry. The functional areas include Balance Sheet, Profit, and Loss, Banking Book, Credit Quality, Market Risk, Assets Under Management, Interest Income, Trading Income, Funding, Capital and Liquidity.

This model example is showcase the art of the possible. Our configurable Application found here

Features

End to End Planning

- Starting with actual data and adding statistical and ratio data, along with different requirements from other aspects of the business that will provide a strategic view of the financial statements.

Multiple Scenarios

- Increased opportunities for inputs can lead to various outcomes and better strategic decisions.

Increased Granularity

- Visibility into Products and Accounts at different levels will ensure more accurate forecasts.

Cohort Analysis

- Simply view cohorts of data across the timescale and drill down to see specific details regarding the output.

Information

Size

93.5 MB

Language

English

Stats

Modules

74

Roles

1

Formulas

423

Reports

20

Complexity

Master

termsTitle